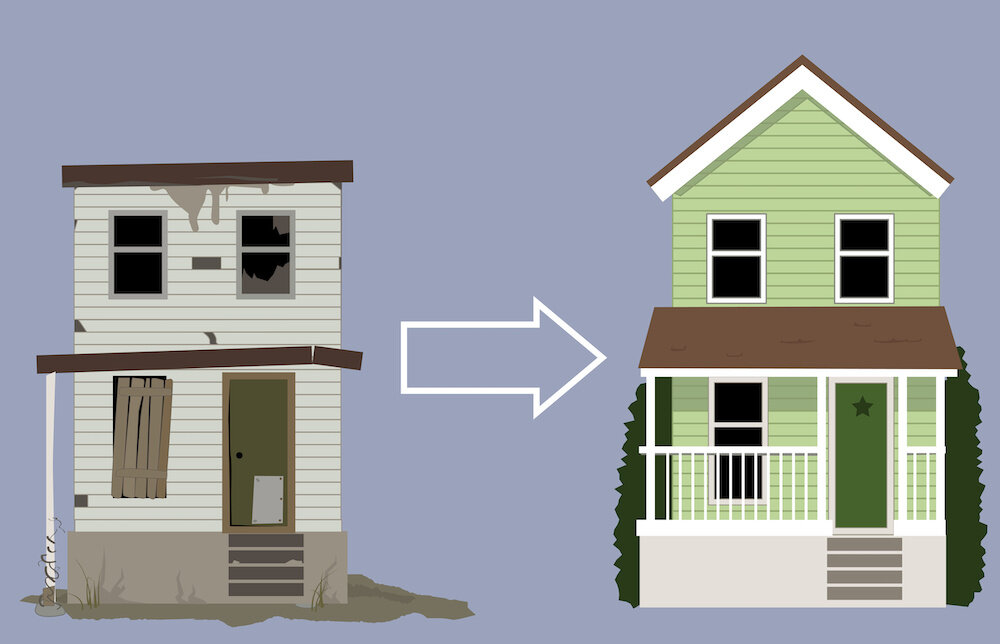

Are you interested in breaking into the house flipping industry but unsure how to begin with limited funds? Fear not, it’s a common starting point!

Countless individuals kickstart their real estate ventures from scratch, even without initial capital! This piece explores 4 strategies for flipping houses with no funds in TX.

4 Ways to Flip Houses With No Money in TX

Flipping houses with no money may sound like a daunting task, but it’s achievable and many people successfully do it regularly. To embark on this journey, thorough research and understanding of the process are crucial. You must explore the various funding options available to determine the best fit for your unique situation.

Developing a detailed business plan is essential to map out your house flipping strategy effectively.

Find Some Partners

Consider individuals within your network who might be interested in real estate investment. Don’t limit yourself to just acquaintances; be open to presenting your investment proposal to new connections as well. This could include friends, relatives, colleagues, or even fellow real estate investors who might consider a partnership.

After discussing your plan with a potential partner, you can organize for them to fund the transaction, while you handle the operational aspects to ensure successful completion.

Loans – Hard Money & Private

Securing financing, whether through hard money lenders or private investors, can be a savvy move when investing in real estate in Dallas - Fort Worth. A private money loan presents an appealing option, tapping into individuals eager to grow their wealth by partnering with you.

Many potential investors are unaware of the opportunities available. By presenting a well-defined plan and articulating the benefits of collaboration, you can attract private money lenders keen to fund your venture.

On the other hand, hard money loans offer a quick financing solution, albeit with higher interest rates and additional points. Optimal for properties with a fast flip potential, these loans provide rapid access to capital, emphasizing the importance of timely repayment.

Use What You Got

Even if you find yourself short on cash, there are other avenues to explore for securing the financing you need. Consider leveraging assets such as a owned property, IRA, or 401k to obtain a line of credit. However, be cautious of potential risks and tax implications that may arise from tapping into these accounts prematurely for a down payment.

Mix & Match

Even if you find yourself unable to secure all the necessary funding through traditional methods, there are creative ways to piece together the financing required to reach your real estate investment goals.

For instance, you might receive a loan for a portion of the downpayment from a generous family member while utilizing funds from your IRA for the rest. Alternatively, you could form a partnership with a local investor, contributing only a fraction of the investment capital by leveraging a hard money loan.

Regardless of the approach you take, conducting thorough research is crucial. Explore all potential avenues of credit that may be accessible to you!

Are you ready to begin your adventure flipping houses? Our awesome team can help you get started today! Click here to fill out our form, or give our office a call today! (214) 983-1833